Committed to helping businesses with AML compliance

We are here every step of the way to guide you through the process of AML due diligence

The 5th Anti-Money Laundering Directive passed in to UK law in January 2020 and compliance is now a compulsory part of the art market.

Failure to make that effort can constitute a criminal offence, however it also an opportunity to safeguard transactions and boost confidence among your clients; protecting your business from risk and improving the general image of the market.

We started ArtAML™ to provide a simple and complete solution for the art market, designed with our customers in mind.

Our journey to launching ArtAML™

In September 2018, our CEO Susan J Mumford — an art world veteran — learned at the Art Business Conference (London) that Anti-Money Laundering legislation would be hitting the art market in less than 18 months. She simultaneously felt concerned for the art market and sympathethic for governments trying to prevent the industry being a target of criminal activity. In a matter of days, she and her Co-Founder / CTO Dr. Chris King, a technologist, were working on a solution that started being used by Art Market Participants in summer 2020.

After developing a mobile application protype in the first half of 2019, our Co-Founders took part in HM Treasury’s Consultation on the ‘Transposition of the Fifth Money Laundering Directive’ in June 2019. ArtAML™’s official response to the consultation can be seen here. This was followed by a meeting with HM Revenue & Customs in autumn 2019, as Supervisory Body for Art Market Participants under the Money Laundering Regulations (UK). Susan and Chris continue to meet HMRC on a regular basis and discuss numerous issues around the topic of art.

The platform has been built to make future releases swift to implement, with the entirety of the solution ready to integrate with other technology solutions, such as transactional marketplace platforms and fellow technology providers for the art market.

Helping our customers adapt and succeed

We listened to the needs of the art market which resulted in our all-in-one AML solutions that serve all AML needs.

Following the summer 2020 launch of the ArtAML™ platform for conducting AML checks, we introduced AML Training in addition to Risk Assessments + AML Policies in spring 2021.

Meet the founders

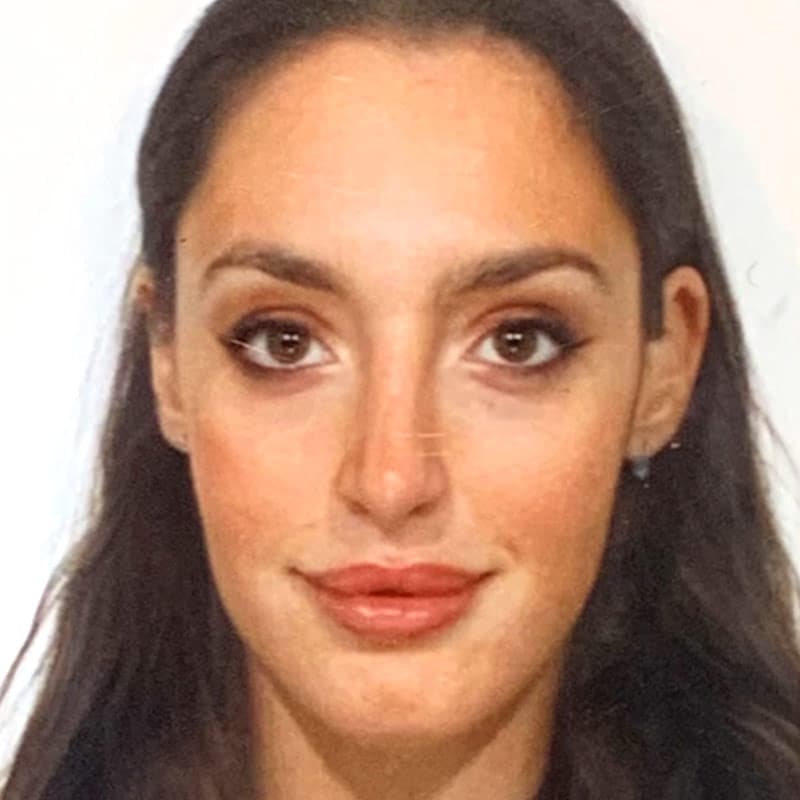

Susan J. Mumford M.A.

CEO and Co-Founder

After a decade operating as an art dealer and adviser, American entrepreneur Susan J Mumford has built a career providing solutions for the art industry, based out of Lewes, East Sussex. She’s also Founder & CEO of the Association of Women Art Dealers (AWAD). A keen amateur gardener, she can often be found in the garden with her hands in the soil.

Dr. Chris King PhD

CTO and Co-Founder

Dr. E. Chris King is an experienced software developer with 25 years’ experience in the financial sector. His most recent work has been developing cutting edge onboarding and KYC solutions. He spends his free time pursuing fine art photography (represented by the Ivy Brown Gallery, New York) and making jewellery.

This [the 5th EU AML Directive] is going to incur a seismic shift for the art market and the way it does business.

Susan J. Mumford

ArtAML™ Chief Executive

The Art Newspaper, October 10, 2019

Meet the team

Martin Bealey

Finance Director

Chartered Accountant (EY). BSc Economics (Bristol University). 30+ years board level experience: The Debt Management Office, a Bank of England/Treasury Agency; Standard Chartered Bank; PA Consulting; and operating in 15+ smaller businesses where annual revenue ranged from £1m to £50m.

Harry Sweetman

Finance Manager

Harry is a qualified bookkeeper and Xero-certified advisor specialising in cloud accounting. He has acquired extensive knowledge and experience of finances, working with both start-ups and established businesses covering a wide range of sectors, including not-for-profit.

Pere Villega

Developer

Pere has a Master’s Degree in Computer Science, with more than 10 years’ experience in software development. He is passionate about new technologies, best practices, and mentoring junior developers.

Lance Walton

Developer

Lance has 24 years of software architecture, design and development experience in financial markets, investment banking, health provision, internet technologies and academic research. He is a Scrum Master and XP coach, mentor and advisor in Agile Methods of software development. He has a talent for getting systems into production where organisations have previously struggled to do so.

Channing Walton

Developer

Channing has three decades of software architecture, design and development experience in financial markets, investment banking, internet technologies and academic research, and has worked with agile methods since the late 1990s. He specialises in helping struggling projects to succeed, and also in building highly effective teams that deliver robust systems.

Simon Davies

Developer

Simon has 14 years experience as a web developer in a range of different sectors working in both front-end and back-end languages.

Francesca Imperiali

Paralegal

Francesca is a multilingual Italian legal specialist with a deep-rooted passion for the art market. Combining her legal studies with hands-on experience in the art world, she has worked at three prominent London galleries and served as a studio manager for a renowned New York artist, overseeing consignment agreements, exhibition logistics across the U.S., and legal matters related to taxation and visas. She then specialised in AML compliance, focusing on regulatory frameworks within the art sector, and is thrilled to bring her knowledge and passion to ArtAML™

Emerald Mosley

Design and Operations Manager

Emerald has worked in multidisciplinary teams, as well as an independent consultant, across product and digital design for over 20 years. During that time she used her creative, mentoring and leadership strengths as well as her problem solving and design skills.

She’s happy to be bringing her clear communication, systems approach and collaborative nature to ArtAML™ to help deliver a great user experience

Grace Davis

Customer Experience Consultant

Grace is an experienced, client-focused professional with a background spanning Executive Search, Tech Recruitment, and Talent Coaching. Holding a degree in Psychology and currently pursuing a Master’s in Computer Science (AI), she excels at aligning organisational goals with customer needs. She has supported C-level executives and delivered high-impact solutions across diverse sectors and countries. Proficient in CRM platforms and project management, she is thrilled to bring her passion for seamless user journeys and collaborative problem-solving to ArtAML™

The Real Workers

Milo Mumford-King

CDO

Proud Staffy-Jack dog and Chief Dog Officer, Milo comes to ArtAML™ after a distinguished career in London. His duties include meeting with the CTO (Chief Treats Officer), as well as liaising with his Human Resources to ensure that the quality and quantity of tummy rubs are up to expected standards.

Zorro Sweetman

Hedge Fund Manager (Ivy league)

A pygmy goat, he is a character, and loves to eat (anything really but especially ivy and chocolate cake). Lives with his mum in the field next door. Motto : “If you cannot clothe yourself with the skin of a lion, put on that of a goat. From now on I shall be Zorro, the goat!

Lord Aslan Tubbington

Head of New Ventures

This is Lord Aslan Tubbington, or Aslan. He clearly knows how handsome he is and fears nothing it seems.

Nyx Villega

VP of Napping

Nyx is a male Ragdoll, with too much energy for the household and a penchant to climb walls (literally). As you can see by his face, he’s the highly-qualified VP of napping.

Sky Villega

VP of Exploration

Sky, a female Ragdoll, is 9 months old, and half-sister of Nyx. Luckily she has less energy when awake, but she compensates that by being the VP of Exploration. Inspect any cupboard you open before closing, as it is likely she got in without you noticing.

Rocky Walton

Junior Canine Developer

Rocky is a terrier mix. He’s unusually quiet for a terrier but not if approached by a broom, and extremely happy to meet anyone.

Need AML sorted?

Breathe a sigh of relief: at ArtAML™ we have a range of AML solutions to help guide your art business.

Customer Due Diligence

By using our platform designed specifically for Art Market Participants, we help you to fulfil compliance obligations without losing sales.

AML Policy and Risk Assessment

Find peace of mind with our comprehensive risk assessments and AML policy.

ArtAML™ Training

ArtAML™ Training will cover what you need to know about the Money Laundering Regulations and Proceeds of Crime Act to meet compliance obligations, provide insights for mitigating risks and protect your business.