The UK regulator for Art Market Participants (“AMPs”) is now visiting art fairs as well as conducting full interventions of regulated art businesses.

Art fair visits

If you’ve recently exhibited at an art fair in the UK, you might have met one of the team members from HMRC’s Art Market Participant (“AMP”) department. The point of these visits was awareness of the legal requirement to register as an AMP with HMRC if you’re actively involved in transactions of works of art in which the total transaction value (not your commission) is €10K+. While there are presently challenges with non-UK AMPs being able to register*, the current requirement is that such businesses registering in order to continue UK-based transactions at €10K+ in works of art.

UPDATE (24th February 2023): Have you received a demand to register as an AMP from HMRC?

If the answer is “yes”, you can no longer take advantage of a 50% discount available for voluntary registration.

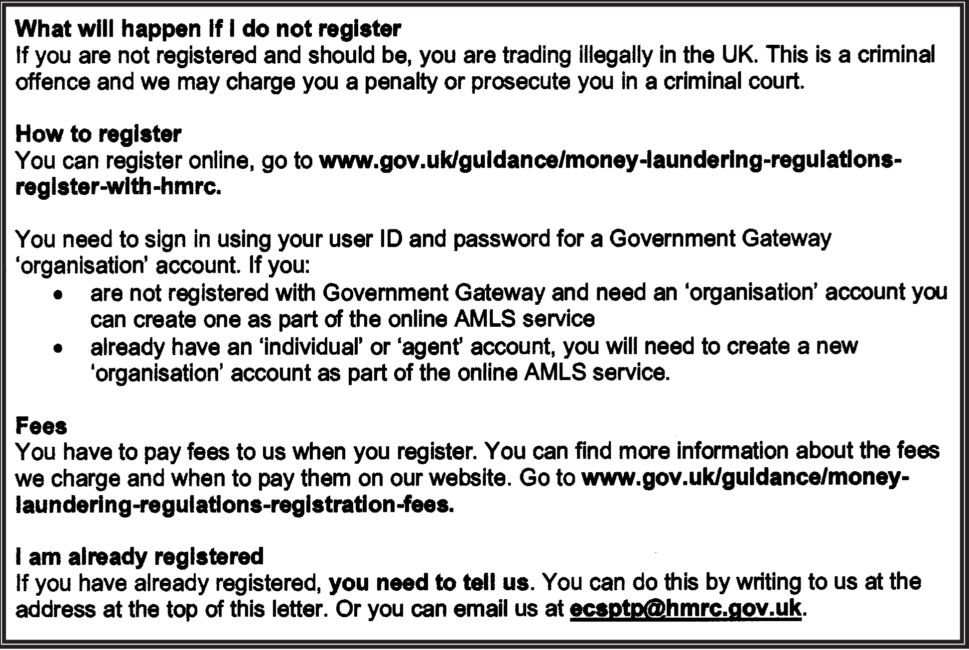

The letter includes the following:

Are you yet to receive a demand to register as an AMP?

You can take advantage of a 50% discount for ‘voluntary registration’. This includes exhibitors at the London Art Fair and other shows who have been visited at the show by the AMP team, but who have not been separately contacted at the gallery by HMRC with a demand to register. Exhibitors at shows visited by HMRC are now firmly on the regulator’s radar, and might be directly contacted at any time with a demand to register.

There is a discount available to anyone who receives a penalty for late registration (either voluntary or by demand):

A 25% discount is available if you make payment within 30 days of receiving a penalty.

Take note: As part of registration, you will be asked if you have in place:

- A risk assessment

- An AML policy (with policies, controls and procedures)

- AML Training

- Guidance for identifying and reporting any suspicious activity

If you don’t have any of the above in place, your application to be approved as an AMP might be stalled and, if not resolved, is subject to being rejected.

We implore any business that should be registered as an AMP and is yet to do so to immediately take action. The longer you wait, the higher the penalty that will be incurred. Not only will you pay more £ in penalties, you will be publicly named and shamed on gov.uk for late registration.

Interventions

We’re also aware that registered AMP businesses are being directly contacted by HMRC, typically by telephone and then email, before arranging an intervention to take place up to four weeks later. This is understandably causing concern, as what you originally put in place might not be sufficient in the eyes of HMRC today.

You might ask yourself:

- “Will the risk assessment and policy (which are separate documents) be sufficient?”

- “Has the business been keeping up-to-date with compliance developments via an appropriate level of training standard?”

- “Are we conducting Customer Due Diligence (CDD) proportionately to the risk that is present?” For example: If you don’t meet some clients face-to-face, are you ‘verifying’ their identity at a high, rigorous and objective standard, as laid out in the BAMF Guidance (June 2022)?

If you’re not sure about the above and would like to have a health check conducted on your compliance set-up, get in touch. We’ve recently released this standalone product in our platform.

In conclusion

Three years ago, AMP businesses had a legal obligation to comply with the ML Regulations, yet were given an opportunity to learn what this meant and put a compliance infrastructure in place. Owing to the pandemic, additional time was provided to register with HMRC in order to continue legally transacting in works of art at €10K+. Today, you’re expected to be fully up and running and will literally pay the consequences if this is not the case.

Further reading

- *Do non-UK businesses need to register for UK-based AML Supervision if transacting at fairs?

- Publicly listed penalties: A new reality for late registration as an Art Market Participant (UK)

- How penalties are calculated for late registration as an Art Market Participant

- Register or renew for Anti-Money Laundering Supervision – and how to contact HMRC

This blog post was originally published on 9th February 2023 and has since been updated to reflect enforcement updates.